What are NQSOs, ESPPs, ISOs, Restricted Stock, and RSUs? at Intuit TurboTax website

Employee Stock Purchase Plan (ESPP)

In a typical Employee Stock Purchase Plan (ESPP), you agree to set aside a portion of your pay. Twice a year, the money is used to purchase stock at a discount, at either 15% below the current price or some previous market price, whatever is lower, so you always get at least 15% off. If you're eligible for this plan, you should participate to the maximum allowed. Your employer is basically giving you free money, without risk, if you sell the stock as soon as you receive it. The information provided below covers this situation (selling the stock soon after purchase).The cost basis of your stock is the value of the stock on the day you purchased it, not what you paid for it, because the "bargain element" is already included as income in your W-2 wage statement, Box 1; and also in Box 14 with notation "DISQE" (disqualifying disposition) or something similar. The 1099-B Gross Proceeds statement from your stockbroker adds to the confusion by reporting the amount you paid for the stock in the box or column labeled "Cost or Other Basis." On schedule D, you need to adjust this reported "Cost or Other Basis" by adding back the bargain element shown in W-2 box 14, or by calculation the "bargain element."

For example, let's say that $4,000 of your money was used to purchase stock worth $5,000. The "bargain element" is $1,000. You sell the stock the next day for $1,015. Your cost basis is $5,000 and your capital gain is $15. W-2 Box 14 shows your bargain element as $1,000 and your total income in W-2 Box 1 already includes your $1,000 bargain. Your broker reports your "Cost or Other Basis" as $4,000, the amount you actually paid. You need to adjust this basis upward by $1,000.

Employee Stock Purchase Plans at Intuit TurboTax website

(information on Disqualifying/Qualifying disposition; how the bargain element is reported on W-2 form, or not)

Do I need to enter ESPP Transactions? at Intuit TurboTax website

(short answer: Yes if you sold the stock, No if you hold on to the stock)

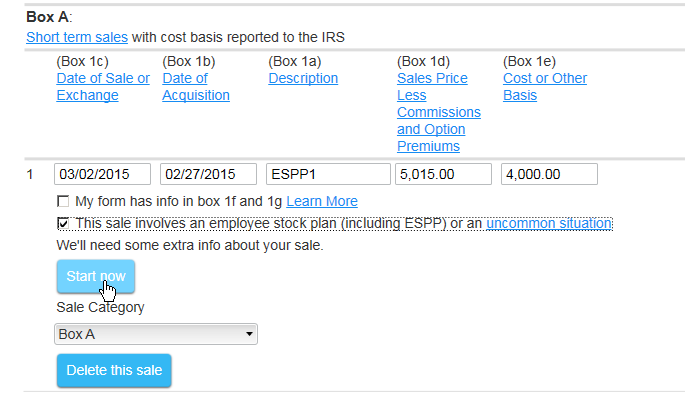

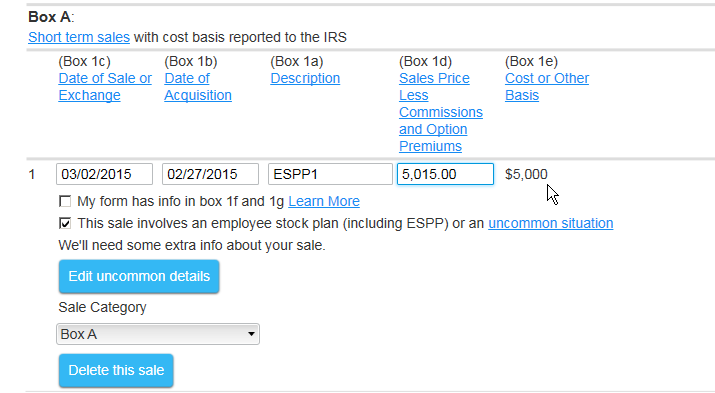

In TurboTax 2015 step-by-step mode, entering the sale information looks something like this:

Federal Taxes > Wages & Income > I'll choose what I work on >

Investment Income - Stocks, Mutual Funds, Bonds, Other [Update (or Start)] >

[Edit or Add More Sales] > Confirm Your Financial Institution Info >

Here's what we've got for these sales [Edit] >

Review your Box A sales from your 1099-B from E-Trade (or other broker)

Enter the date of sale, date of acquisition, and sales price ($5,015). Then check the box that says "This sale involves an employee stock plan (including ESPP) or an uncommon situation"

Under "We'll need some extra info about your sale," click [Start now]

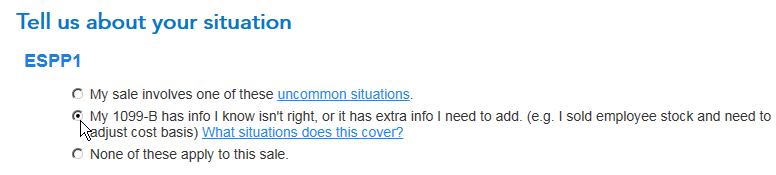

Under "Tell us about your situation, choose "My 1099-B has info I know isn't right, or it has extra info i need to add. (e.g. I sold employee stock and need to adjust cost basis)." Then click [Continue].

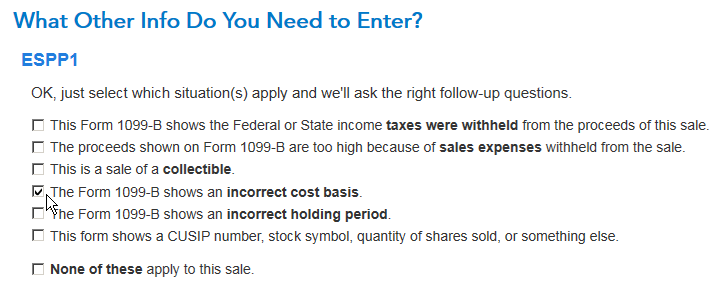

Under "What Other Info Do You Need to Enter?," choose "The Form 1099-B shows an incorrect cost basis." Then click [Continue].

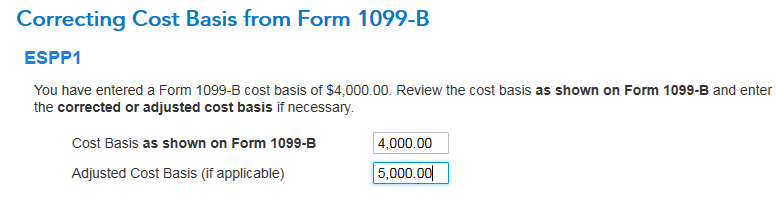

Under "Correcting Cost Basis from Form 1099-B," in the "Adjusted Cost Basis (if applicable)" field, enter the value of the stock on the day you acquired it. This is your cost ($4,000) plus the "bargain element" ($1,000), which is also the amount in your W-2 form, box 14, DISQE (or similar) notation. With the corrected cost basis ($5,000) entered, click [Continue].

Now the "Review your Box A sales from your 1099-B from (your broker) show the corrected cost basis.

Now on Schedule D you'll be charged a capital gains tax on the $15 gain from the day of acquisition to the day of sale, not the full profit of $1,015. Remember the bargain element of $1,000 is already added to Box 1 of your W-2 form, so you're already paying the tax on that part. Don't double-pay your tax!

Repeat the same procedure for your other ESPP sales during the year.

Restricted Stock Units (RSUs)

Restricted stock units (RSUs) are shares of stock that your employer gives to you for free as a reward for good work and an incentive to stay with the company. You pay nothing for the stock, so your true cost basis is zero. Typically, the shares are "vested" (you are allowed to sell them) one block at a time, once a year over several years.When you sell the shares from your brokerage account, the "bargain element" is the full value of the shares sold. What's really confusing is that the broker sells the shares in two blocks: one block to pay withholding taxes, and another block to give you some cash. The broker only reports the second block on the 1099-B form and shows your "Cost or other basis" as zero, but your employer reports the value of both blocks as income on your W-2 form.

Let's look at an example. You sell your RSU shares worth $7,000. The broker sells enough shares to pay $3,000 in withholding taxes to Uncle Sam and maybe your state tax board, and also sells $4,000 more and gives you the cash. Your W-2 Box 14 shows your "bargain element" as $7,000, and this $7,000 is also included in your total income shown in W2 Box 1. So you've already paid the tax on the $7,000 bargain. However, your 1099-B form only shows the $4,000 stock sale and a cost basis of zero, an apparent gain of $4,000. You need to adjust the cost basis to $4,000, so that a net profit of zero is reported on Schedule D.

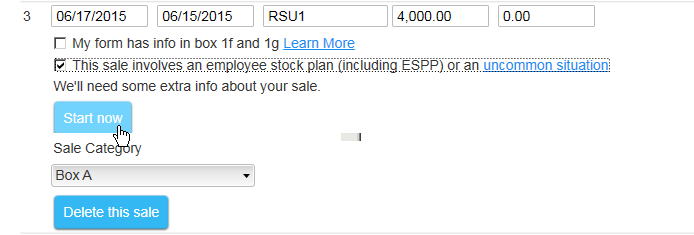

In TurboTax 2015 step-by-step mode, entering the information looks something like this:

Federal Taxes > Wages & Income > I'll choose what I work on >

Investment Income - Stocks, Mutual Funds, Bonds, Other [Update (or Start)] >

[Edit or Add More Sales] > Confirm Your Financial Institution Info >

Here's what we've got for these sales [Edit] >

Review your Box A sales from your 1099-B from E-Trade (or other broker)

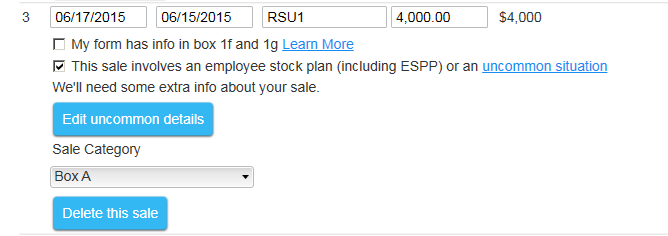

Enter the date of sale, date of acquisition, and sales price ($4,000). Then check the box that says "This sale involves an employee stock plan (including ESPP) or an uncommon situation"

Under "We'll need some extra info about your sale," click [Start now]

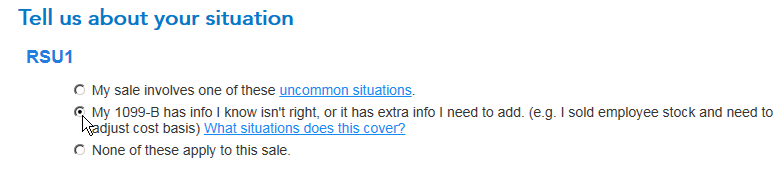

Under "Tell us about your situation, choose "My 1099-B has info I know isn't right, or it has extra info I need to add. (e.g. I sold employee stock and need to adjust cost basis)." Then click [Continue].

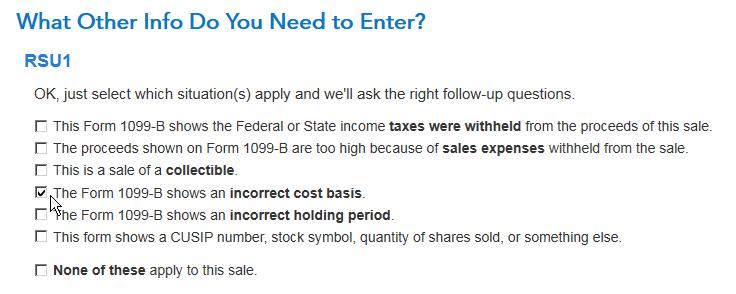

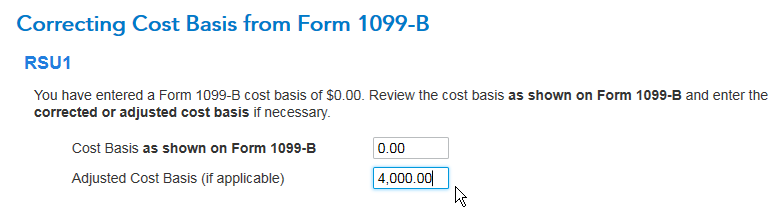

Under "What Other Info Do You Need to Enter?," choose "The Form 1099-B shows an incorrect cost basis." Then click [Continue].

Under "Correcting Cost Basis from Form 1099-B," in the "Adjusted Cost Basis (if applicable)" field, enter the amount of cash you received ($4,000), not including the shares sold to pay your withholding taxes. With the corrected cost basis ($4,000) entered, click [Continue].

Now the "Review your Box A sales from your 1099-B from (your broker) show the corrected cost basis.

Now on Schedule D you'll be charged a capital gains tax of zero, not the cash you received ($4,000) or the full value of the stock sold ($7,000). Remember the bargain element of $7,000 is already added to Box 1 of your W-2 form, so you're already paying the tax on it. Don't double-pay your tax!

Repeat the same procedure for any other RSU sales during the year.

How to Report RSUs or Stock Grants on Your Tax Return at Intuit TurboTax website

Non-Qualified Stock Options

Non-qualified stock options are stocks that you have an option to buy at some market price from earlier in your career at your company. You can either buy the stock outright at a discount price and hold on to it for a later day, or more commonly, you do a "same-day sale," in other words, you sell the stock immediately and use the proceeds to pay for the stock at the discounted price, and pocket the difference, minus withholding taxes.The "non-qualified" part means that you must pay taxes on the "bargain element" immediately when you buy the stock, whether or not you sell it immediately. (Qualified "incentive stock options" are not as common and beyond the scope of this web page.)

The tax treatment is similar to an RSU sale in that a portion is sold to pay withholding taxes. Check your W-2, pay stubs, and 1099-B forms carefully and adjust your cost basis appropriately, similar to the procedures above for RSU sales.

Non-Qualified Stock Options at Intuit TurboTax website

More information is available at SFGate, How to avoid paying double tax on employee stock options